Is the American Dream Getting Taxed? What the New U.S. Remittance Tax Means for NRIs

The United States has long been the land of opportunity for Indian professionals. From tech campuses in Silicon Valley to Wall Street firms in New York, Non-Resident Indians (NRIs) have built successful careers and sent significant portions of their earnings back home to support families, build assets, and contribute to India's economic rise.

But the “American Dream” might be getting more expensive.

In a controversial move, the U.S. House of Representatives recently passed a 1,000-page budget bill backed by Donald Trump’s campaign. Nestled within it is a proposal to impose a 3.5% tax on international remittances sent by non-citizens — a category that includes H-1B visa holders and green card applicants, two of the most common statuses among Indians in the U.S.

The proposal, which initially targeted a 5% tax before being revised down, still has to pass the U.S. Senate — but its very existence has sent shockwaves through the Indian diaspora.

Why This Matters for NRIs

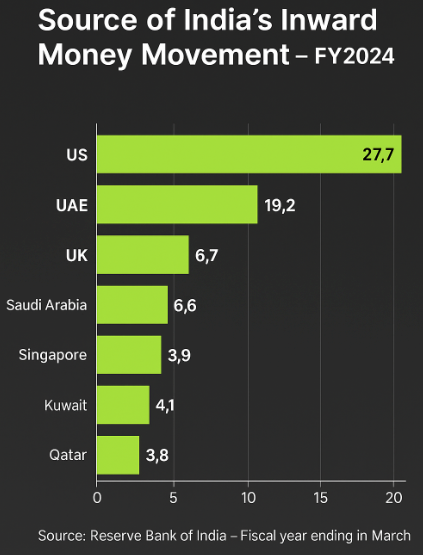

India is the world’s top recipient of remittances, and nearly 28% of that comes from the U.S. alone. In 2023–24, Indians in America sent home over $32 billion, with many individuals transferring up to 20% of their income.

For NRIs already facing challenges — including visa limitations, rising rent and education costs, and tight job markets — a remittance tax threatens to cut into their hard-earned savings.

What Could Happen Next?

If the bill is enacted:

- A remittance rush may occur in 2025 as NRIs send money before the tax kicks in.

- Post-tax, remittance flows may dip, as senders reduce volumes or turn to informal channels.

- Trust in formal financial systems may erode, particularly for young migrants trying to repay student loans or support families back home.

And while India’s macroeconomy may absorb the impact, individual NRIs will feel the pinch deeply.

What Can You Do Now?

At Panda Money, we believe your dreams shouldn’t be taxed unfairly. As a transparent and NRI-focused money movement platform, we’re watching this development closely — and are committed to helping you:

- Transfer money faster before any new laws take effect

- Understand cross-border tax implications

- Access low-fee transfers using Google FX rates with no hidden charges

- Stay compliant while staying empowered

As U.S. policy shifts, NRIs need to stay informed and prepared. Whether this bill becomes law or not, it highlights the growing need for trusted, transparent, and NRI-first financial services.

Stay with Panda Money — where your money moves smarter.

Click on the Whatsapp Link and Say "Hi"

#Hashtags:

#NRIs #RemittanceTax #AmericanDream #PandaMoney #NRIFinance #H1B #SendMoneyHome #CrossBorderPayments #NRIChallenges