Understanding USD to INR Exchange Rate Historical Trends: Why It Matters & How to Get the Best Rates

The USD to INR exchange rate has always been a topic of interest for businesses, investors, and NRIs sending money back home. Whether you're planning an international transfer, investing in foreign assets, or simply monitoring market trends, understanding historical exchange rates can help you make better financial decisions.

Why Should You Track Exchange Rate Trends?

Exchange rates fluctuate daily due to multiple economic and geopolitical factors. A small difference in the rate can impact the value of remittances or international transactions significantly. Keeping an eye on trends allows you to:

- Get the Best Rates: Timing your transfer when the rupee is stronger against the dollar can help you save money.

- Plan Financial Decisions: Businesses involved in international trade benefit from tracking rates to hedge currency risks.

- Maximize Investments: Investors trading in forex or international assets can leverage favorable exchange rate trends.

Historical Trends in USD to INR Exchange Rates

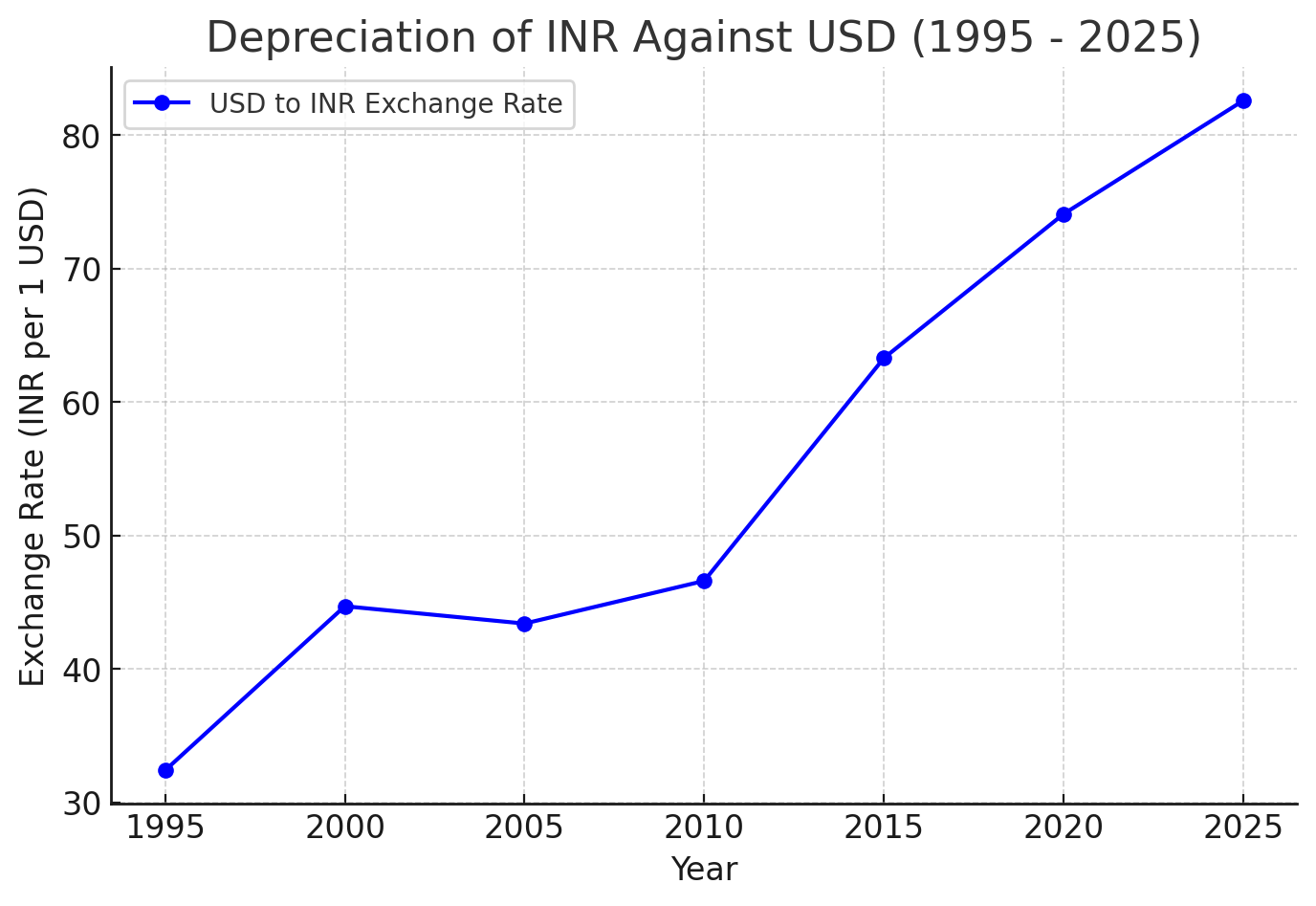

Over the last few decades, the Indian Rupee has depreciated against the US Dollar, influenced by inflation, economic policies, and global events. Here’s a quick snapshot of the major milestones:

- 1991: 1 USD = ₹17.90 (Post-economic liberalization)

- 2000: 1 USD = ₹44.94

- 2010: 1 USD = ₹45.73

- 2020: 1 USD = ₹74.10

- 2024: 1 USD = ₹83.00+ (fluctuates based on market conditions)

Graph: USD to INR Exchange Rate Over the Years

Factors That Influence USD to INR Exchange Rates

Several factors play a role in determining exchange rate fluctuations. Understanding these can help predict trends:

- Inflation Rates: Lower inflation in India strengthens the INR, while higher inflation leads to depreciation.

- Interest Rates: A higher interest rate in India attracts foreign investments, boosting demand for INR.

- Trade Deficit: When imports exceed exports, it increases demand for USD, weakening INR.

- Foreign Exchange Reserves: Higher reserves improve market confidence and stabilize INR.

- Global Events & Oil Prices: Crises, wars, and crude oil prices directly impact India’s forex market.

- US Federal Reserve Policies: A stronger USD due to Fed interest hikes results in INR depreciation.

How to Get the Best Exchange Rates?

- Monitor Trends: Use forex tracking tools to identify the right time to exchange currency.

- Compare Providers: Avoid banks with high hidden fees and look for services that offer real-time rates.

- Use Forward Contracts: Lock in favorable rates in advance if you expect a future transaction.

Get the Best Rates with Panda Money

If you're an NRI looking for an easy and cost-effective way to send money to India, Panda Money is the smarter choice. Here’s why:

✅ Transparent Fees: No hidden charges—what you see is what you pay.

✅ Immediate Settlement: Fast processing, ensuring your money reaches its destination without delays.

✅ Google FX Rates: Enjoy real-time, fair exchange rates without markups.

✅ Socially Responsible: 25% of profits go to charitable causes.

✅ Financial Education: Get expert tips on building credit scores and managing finances in the USA.

💡 Visit GetPanda.Money to start sending smarter today!